Trump Tariffs Spark Global Turmoil as China Retaliates with Steep Import Taxes :

April 11, 2025 | By [Christopher E Wilson]

Global financial markets were rattled on Friday as China unveiled a harsh retaliatory response to the United States’ latest round of tariffs, escalating an already tense trade war that has drawn criticism and concern from world leaders. In a significant escalation, Beijing announced that it will impose tariffs of up to 125% on a wide range of U.S. imports. The move came just hours after the White House clarified that the United States will tax Chinese goods at an effective rate of 145%, despite an earlier post by former President Donald Trump that incorrectly stated the figure as 125%.

The announcement sent shockwaves through financial markets. Asian stocks plummeted, with major indices across Tokyo, Shanghai, and Hong Kong posting sharp losses. Investors had barely recovered from the whiplash of Thursday’s rally — driven by a brief wave of optimism following Trump’s initial, now-disputed tariff announcement — before Friday’s downturn reversed much of those gains.

Trump’s Trade Gamble

Former President Trump, who is currently campaigning for a potential return to the White House in 2025, reignited his aggressive protectionist agenda with a sweeping tariff package aimed at punishing China for what he claims are decades of unfair trade practices.

“China has taken advantage of us for too long,” Trump wrote on his social media platform Truth Social on Wednesday. “We’re finally standing up for American workers and businesses.”

However, confusion erupted when the White House later issued a clarification indicating that the total effective tariff rate on certain Chinese goods would reach 145%, once previously announced layers of tariffs are factored in. This correction has not only aggravated tensions with Beijing but also shaken confidence in the U.S. administration’s messaging and strategy.

China’s Swift Response

China’s retaliatory measures were swift and sweeping. Tariffs as high as 125% will now be applied to a broad array of American products, including agricultural goods, automobiles, and industrial machinery. The decision was confirmed by China’s Ministry of Commerce early Friday and is set to take effect immediately.

“China will firmly defend its national interests and the multilateral trading system,” the ministry said in a statement. “We urge the United States to return to the path of dialogue and cooperation.”

The escalation is likely to have far-reaching consequences not just for the U.S. and China, but for the global economy at large. Economists warn that the tit-for-tat tariffs could significantly dampen international trade, hike prices for consumers, and slow down global growth.

Xi Jinping: China, EU Must Resist ‘Unilateral Bullying’

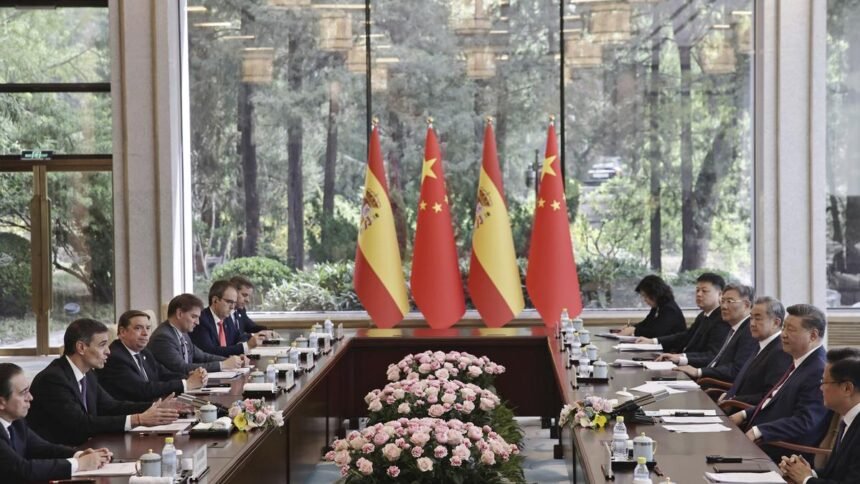

As the trade war intensifies, Chinese President Xi Jinping is looking to build a coalition to counter U.S. economic aggression. In a high-profile meeting with Spanish Prime Minister Pedro Sánchez on April 11, Xi urged the European Union to work closely with China in resisting what he termed as “unilateral bullying.”

According to Xinhua, China’s state news agency, Xi emphasized the need for Beijing and Brussels to “fulfil their international responsibilities… and jointly resist unilateral bullying practices.”

The comments appear to be a clear call for the EU to distance itself from Washington’s confrontational stance and instead align more closely with Beijing on trade policy. European leaders, however, are caught in a difficult balancing act — wary of China’s economic clout, yet uneasy about its authoritarian political model and strategic ambitions.

Market Meltdown

The economic fallout from the latest volley in the trade war has been immediate. On Friday morning, Asian markets sank, with Japan’s Nikkei 225 shedding over 3%, and the Shanghai Composite falling more than 4%. Hong Kong’s Hang Seng Index suffered its worst one-day loss in months.

U.S. futures also pointed sharply downward, indicating another rough day on Wall Street following Thursday’s whipsaw trading session. Investors are growing increasingly nervous that a full-blown trade war between the world’s two largest economies could tip the global economy into recession.

“The markets are reacting to pure chaos,” said Anika Rao, global strategist at Halcyon Financial. “First, we had a momentary boost from what appeared to be a manageable tariff package, then the rug was pulled out from under investors when the White House clarified the real numbers. Now, with China hitting back, we are entering uncharted waters.”

Global Repercussions

Beyond financial markets, the geopolitical reverberations are beginning to take hold. Countries across Europe and Asia are reassessing their trade policies, wary of being caught in the crossfire of a deepening rift between Washington and Beijing.

The European Union, while still aligned with the U.S. on many strategic issues, has shown increasing signs of discomfort with Trump-era trade protectionism. Xi Jinping’s comments suggest a calculated attempt to capitalize on that discomfort and drive a wedge between Washington and Brussels.

Meanwhile, developing economies that rely heavily on exports to both China and the U.S. are preparing for potential shocks to their supply chains. Several Southeast Asian nations have already expressed concern that the ongoing trade conflict will derail their fragile post-pandemic recoveries.

Political Ramifications

The tariff war is also reverberating in the U.S. political sphere. Trump’s bold move is seen by many as an effort to shore up support among his base of industrial and agricultural voters, who have long felt sidelined by globalization. But critics argue that such policies are self-defeating, likely to result in job losses, higher consumer prices, and international isolation.

“Trump’s trade war is a disaster in the making,” said Sen. Amy Klobuchar, a leading voice on economic policy. “It’s American farmers, manufacturers, and families who will pay the price.”

On the campaign trail, Trump’s rivals — both Democratic and Republican — are using the tariff debacle to question his judgment and economic leadership.

Looking Ahead

With both Washington and Beijing digging in their heels, there appears to be little appetite for immediate de-escalation. Diplomats on both sides have confirmed that no new trade talks are currently scheduled, heightening fears that this could be just the beginning of a protracted economic conflict.

Analysts warn that unless cooler heads prevail, the global economy may be headed toward a turbulent period reminiscent of the 1930s-era trade wars that exacerbated the Great Depression.

For now, the world watches — and waits — as two superpowers hurtle toward economic confrontation with uncertain consequences.

Trump Tariffs,Trump Tariffs,Trump Tariffs,

Trump Tariffs,Trump Tariffs,Trump Tariffs,Trump Tariffs, Trump Tariffs

“Exciting News! Sejal News Network is now on WhatsApp Channels

Subscribe today by clicking the link and stay updated with the latest news!” Click Here