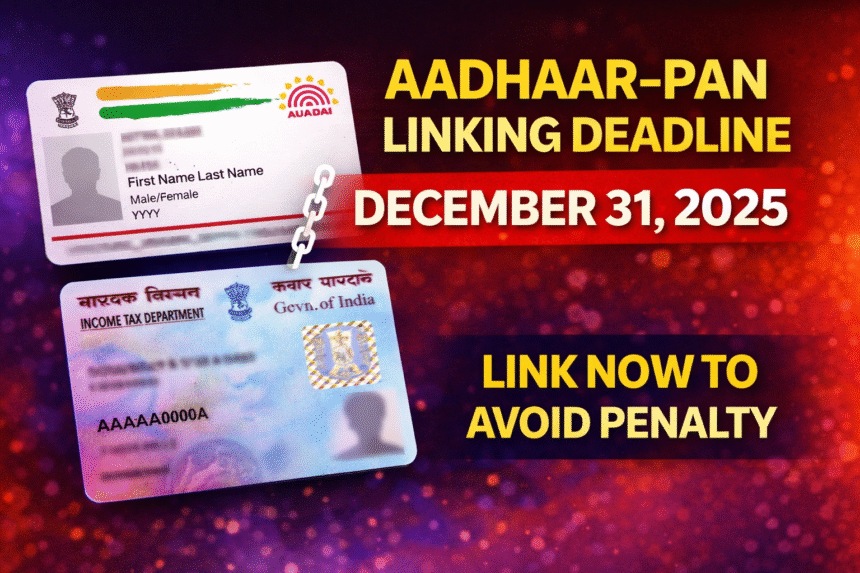

New Delhi / India: Taxpayers across the country have been reminded that linking their Aadhaar and PAN (Permanent Account Number) remains mandatory before the December 31, 2025 deadline. With just days remaining, authorities are issuing final advisories and last-minute guidance to ensure that citizens complete the process smoothly and avoid penalties.

This directive is part of the government’s ongoing effort to tighten financial transparency, reduce tax evasion, and strengthen the integrity of the taxation system. The deadline has sparked both compliance activity and confusion among taxpayers who are now seeking simple steps to complete the linkage without hassle.

Why Aadhaar-PAN Linking Matters

According to the tax regulations, all active PAN holders in India must link their PAN card with their Aadhaar number by December 31, 2025. Failure to do so can lead to the PAN becoming inoperative, which may affect filing income tax returns, claiming refunds, or carrying out financial transactions that require PAN verification.

Officials emphasize that the linkage is essential for:

- Transparent tax compliance

- Accurate identification of taxpayers

- Prevention of tax fraud and duplicate identities

For salaried individuals, business owners, and investors alike, completing the process is crucial to avoid unnecessary difficulties when dealing with tax-related matters.

Step-by-Step Linking Process (Quick and Easy)

If you haven’t linked your Aadhaar with your PAN yet, here’s a simple step-by-step guide to complete it efficiently:

- Visit the Income Tax e-filing Portal

Log in to the official tax e-filing website using your PAN credentials. - Enter Aadhaar Details

Carefully enter your Aadhaar number and name exactly as it appears on your Aadhaar card. - Verify and Submit

Cross-check your details before submission. Any mismatch in name spelling or date of birth could lead to errors. - Confirmation Message

Once submitted successfully, you will receive a confirmation message on the screen. In most cases, linkage is completed instantly. - Rectify Errors If Needed

If your data does not match, you may need to update either your Aadhaar or PAN details with the respective authorities before retrying.

Completing this process well before the deadline helps taxpayers avoid last-minute rush and potential technical glitches.

What Happens If You Miss the Deadline?

Tax experts warn that if Aadhaar and PAN are not linked by December 31, 2025, the PAN could become inoperative. This may lead to:

- Inability to file tax returns

- Difficulty in financial transactions requiring PAN

- Problems in renewing licenses, bank operations, or investments

- Notices or compliance requirements from tax authorities

Therefore, taxpayers are urged not to delay the process further and complete it as early as possible.

Government’s Push for Compliance

Authorities have regularly reminded taxpayers about the urgency of this requirement through advisories and advisory messages. With only days left on the calendar, government bodies are emphasizing that December 31, 2025 is a firm deadline, and no further extension is expected.

^ “It is important that every eligible PAN holder completes the Aadhaar-PAN linkage to avoid any compliance issues,” a senior official said in a statement summarizing the final deadline push.

Tips to Avoid Common Errors

To ensure a smooth linking experience, consider these common-sense tips:

- Ensure your name and date of birth match in both Aadhaar and PAN records.

- Use the official e-filing portal — avoid third-party links claiming to help with linking.

- Keep your Aadhaar and PAN documents handy for accurate data entry.

- If you encounter errors, visit the nearest tax facilitation centre for assistance.

For More News & Updates — Follow Sejal News Network

For the latest breaking news, exclusive ground reports, political updates, entertainment stories, city developments, and national coverage, stay connected with Sejal News Network.

We bring verified information, fast updates, and unbiased journalism — directly to you.

- Website: sejalnewsnetwork.in

- Instagram: @sejalnewsnetwork

- YouTube: Sejal News Network

- Facebook: Sejal News Network Official

- LinkedIn : Sejal News Network

- Play Store App : Sejal News Network

Stay informed. Stay ahead.